Financial Rates by The Pakistan: Investing in bonds is akin to holding a steady stream of future cash payments, typically in the form of periodic interest and the return of principal upon bond maturity. This article delves into the intricacies of bond pricing, explores the concept of “bond yield,” and elucidates how inflation expectations and interest rates intricately determine a bond’s value.

Key Insights

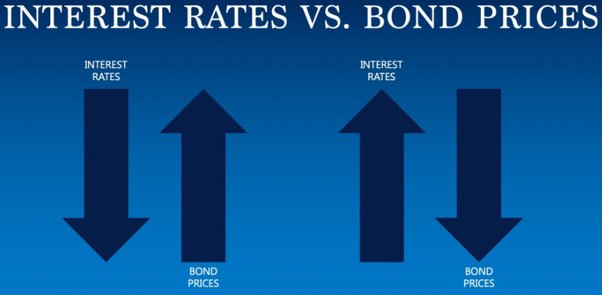

- Bonds face interest rate risk, where rising rates lead to falling prices and vice versa.

- Interest rates respond to inflation; as prices rise, central banks may increase target rates to curb inflation.

- Inflation diminishes the real value of a bond’s face value, especially concerning longer-maturity debts.

- Bond prices exhibit sensitivity to changes in inflation and inflation forecasts.

Risk Metrics

Financial Rates by The Pakistan: Two key risks, interest rate risk and credit risk, must be evaluated when venturing into bonds. While this article primarily focuses on how interest rates impact bond pricing (interest rate risk), acknowledging credit risk is essential. Interest rate risk materialized in the context of the Federal Reserve’s move to raise the federal funds rate during the July 2023 FOMC meeting, with a continued expectation of rate hikes to combat inflation.

Interest rate risk revolves around alterations in a bond’s price due to shifts in prevailing interest rates. Short-term versus long-term interest rate changes affect various bonds differently. Simultaneously, credit risk involves the likelihood of a bond issuer failing to meet scheduled interest or principal payments.

U.S. Treasury Bonds

The article emphasizes U.S. Treasury bonds, issued by the Department of the Treasury to fund government operations, as examples. These bonds are perceived as free of default risk, with investors confident in the U.S. government meeting its payment obligations.

Financial Rates by The Pakistan-Yield and Price

Understanding how interest rates influence a bond’s price involves grasping the concept of yield. The Yield to Maturity (YTM) calculation, a common yield measurement, represents the discount rate making the present value of a bond’s cash flows equal its price. When a bond’s yield rises, its price falls, and vice versa.

Maturity and Yield Curve

The maturity or term of a bond significantly impacts its yield, reflecting the yield curve. Generally, longer-term bonds offer higher yields to compensate for the extended period before cash flows are received. This relationship is integral to comprehending the influence of inflation expectations on investor yield requirements.

Inflation Impact on Bonds

Financial Rates by The Pakistan: Inflation poses a threat to bonds, eroding the purchasing power of their future cash flows. Bonds, typically fixed-rate investments, see a reduced real return when inflation is on the rise. The article notes Treasury Inflation-Protected Securities (TIPS) as a means to counter inflation risk, providing a real rate of return guaranteed by the U.S. government.

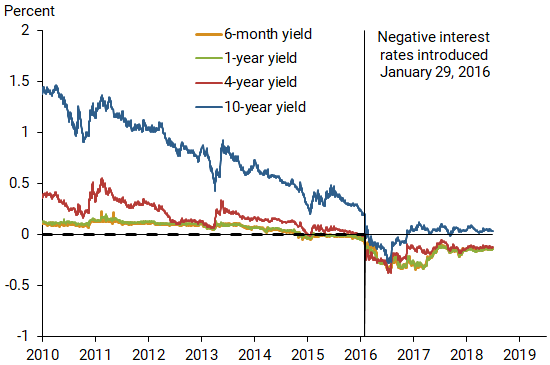

Short-Term, Long-Term Interest Rates, and Inflation

The interplay between short-term and long-term interest rates influences inflation and inflation expectations. Central banks control short-term rates, while market forces determine long-term rates. Expectations of future inflation impact the yield curve, leading to steepening or flattening based on market perceptions of central bank actions.

Cash Flow Timing and Interest Rates

Financial Rates by The Pakistan: The timing of a bond’s cash flows, aligned with its term to maturity, is crucial. Anticipations of higher inflation prompt increased interest rates and bond yields to compensate for the potential loss of future cash flow purchasing power. Bonds with longer cash flows experience more significant yield increases and price declines.

Understanding Nominal and Real Rates

Distinguishing between nominal and real interest rates is vital. Nominal rates are stated rates, while real rates factor in inflation, providing a more accurate depiction of borrowing costs and investment returns.

Inverse Relationship Between Bond Prices and Interest Rates

The article elucidates the inverse relationship between bond prices and interest rates. As interest rates climb, newly issued bonds offer higher yields, making existing lower-yielding bonds less appealing, thereby decreasing their prices.

Significance of the Yield Curve

Financial Rates by The Pakistan: The yield curve illustrates the connection between bond yields and their maturities. Inverted or flat curves can signify economic uncertainty or an impending recession, offering insights into future expectations about global economies.

Safeguarding Portfolios Against Interest Rate and Inflation Fluctuations

Financial Rates by The Pakistan: Diversifying portfolios with assets like stocks, commodities, and inflation-protected securities can mitigate the impact of interest rate changes and inflation. Investors concerned about rising interest rates may benefit from discussing strategies with their financial advisor.

In conclusion, comprehending the intricate relationships between interest rates, bond yields, and inflation is crucial for bond market investors. The article encourages investors to consider various measures of duration and convexity to navigate the dynamic bond market landscape effectively.