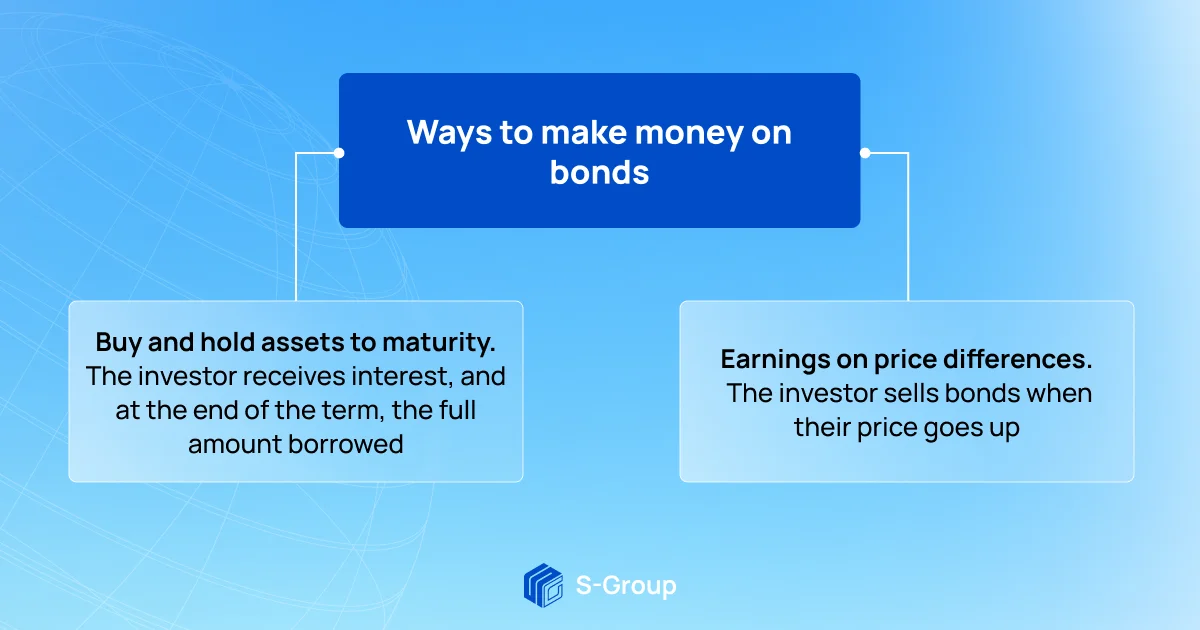

Company Bonds The Pakistan: Issuing bonds stands out as a viable avenue for companies seeking to raise capital, essentially creating a financial agreement between the corporation and investors. In this arrangement, investors provide a specified amount of money to the company for a defined period, receiving periodic interest payments in return. When the bond matures, the company repays the principal amount to the investors.

Key Insights

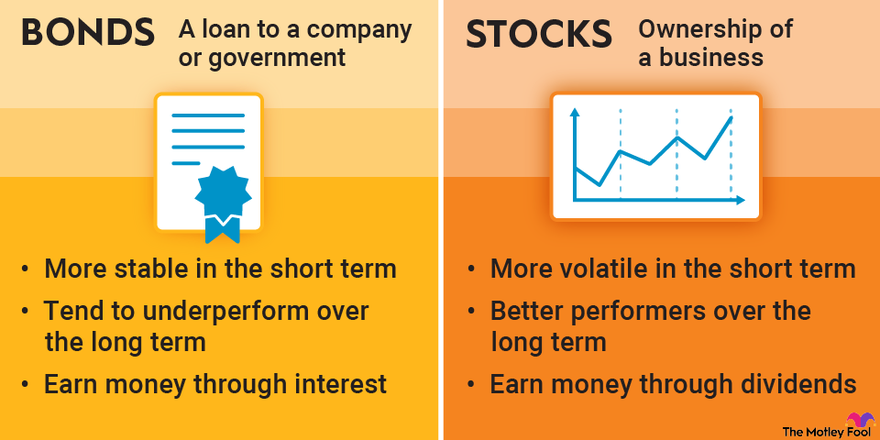

- When companies aim to raise capital, they can opt for issuing stocks or bonds.

- Bond financing is often more cost-effective than equity, and it doesn’t involve relinquishing control of the company.

- Debt financing can take the form of a bank loan or bonds issued to investors, with bonds offering various structuring possibilities.

Bonds vs. Banks

While borrowing from a bank may seem like a straightforward solution, companies frequently find issuing bonds more attractive. Bond investors typically receive lower interest rates compared to what banks demand. This cost efficiency is particularly crucial for companies focused on maximizing profits, prompting even financially stable companies to issue bonds. Unlike bank loans, bonds offer corporations greater operational freedom by avoiding constraints imposed by banks, such as restrictions on debt issuance or corporate acquisitions.

Bonds vs. Stocks

Company Bonds The Pakistan: Companies have the option of raising funds by issuing shares of stock, providing proportional ownership to investors in exchange for capital. While stock issuance does not necessitate repayment, it comes with downsides like dilution of ownership and potential earnings per share (EPS) decrease. Issuing bonds, on the other hand, allows companies to raise capital without affecting ownership. This flexibility makes bonds an attractive choice for companies seeking long-term financial stability.

Company Bonds The Pakistan-More About Bonds

Bond issuance allows corporations to efficiently attract numerous lenders, with simplified record-keeping due to uniform bond terms for all investors. The diversity in bonds is notable, with variations in credit quality, duration, and structure. The ability to issue bonds with different maturities caters to companies with varying funding needs.

Types of Bonds

Company Bonds The Pakistan: Companies can explore diverse bond types based on their requirements. Collateralized debt obligations (CDOs) tie bonds to underlying assets, providing investors with claim rights if the company defaults. Unsecured debt, not backed by assets, poses higher risks but may offer higher returns. Convertible bonds grant investors the option to convert holdings into stock shares, offering flexibility for both investors and companies.

Callable Bonds

Company Bonds The Pakistan: Callable bonds present an intriguing option for companies looking to capitalize on potential future drops in interest rates. By redeeming callable bonds before maturity, companies can reissue debt at lower rates, reducing capital costs. While advantageous for issuing companies, callable bonds entail complexity and may not suit risk-averse investors seeking a stable income stream.

Understanding Corporate vs. Government Bonds

Distinguishing between corporate and government bonds is crucial. Corporate bonds fund business needs, carrying more risk but potentially providing better returns. Government bonds, issued to fund governmental projects, are generally considered less risky.

:max_bytes(150000):strip_icc()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

Safety of Corporate Bonds vs. Stocks

Company Bonds The Pakistan: Corporate bonds are generally perceived as safer than stocks, offering a fixed return and known risks. Stocks, while riskier, may provide higher returns, making the choice between the two contingent on an investor’s risk tolerance and objectives.

Tax Implications of Corporate Bonds

Corporate bonds are not tax-free. Investors must pay taxes on interest income and any capital gains.

For companies, the bond market provides diverse borrowing options, allowing investors to align their choices with specific needs. However, the range of choices in the bond market necessitates thorough research and understanding of associated risks. Financial advisors play a crucial role in guiding investors through the complexities of the bond market, offering insights, recommendations, and risk assessments. Whether investing directly or through bond funds, careful consideration ensures informed decisions aligned with financial goals.

Trade on the Go. Anywhere, Anytime:

Consider one of the world’s largest crypto-asset exchanges for secure and competitive trading. Create a free account on Binance to access tools for trade history, auto-investments, price charts, and fee-free conversions.