Brokerage Explained By The Pakistan: A broker serves as a crucial intermediary between investors and securities exchanges. As exchanges exclusively accept orders from their members, brokers facilitate individuals and firms in executing trades. Brokers are compensated through various means, such as commissions, fees, or payments from the exchange itself. Investopedia regularly evaluates top brokers, offering a comprehensive list of online brokers and trading platforms to aid investors in their decision-making process.

Key Points:

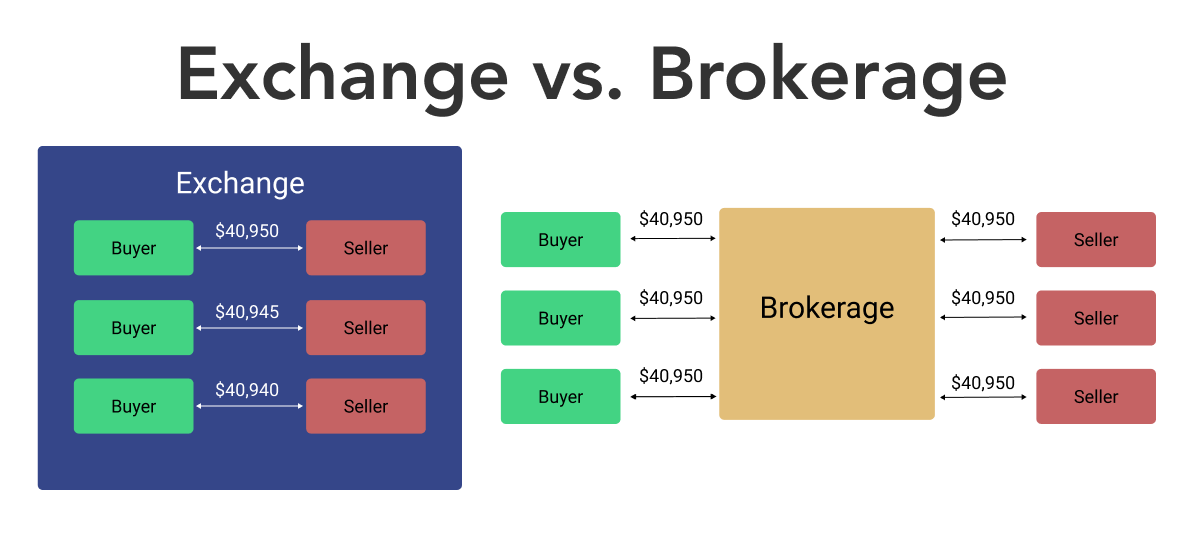

- A broker acts as an intermediary connecting investors with securities exchanges.

- Compensation for brokers can be in the form of commissions, fees, or payments from the exchange.

- Investopedia provides independent reviews to assist investors in choosing the best online brokers.

Types of Brokers:

- Discount Brokers: Execute trades for clients but typically don’t provide investment advice. They operate with a low fee structure, often charging $0 in commissions.

- Full-Service Brokers: Offer execution services along with tailored investment advice, retirement planning, and a range of investment products. Higher commissions are associated with their comprehensive services.

Brokerage Explained By The Pakistan Broker Regulation:

Brokerage Explained By The Pakistan: Brokers register with the Financial Industry Regulatory Authority (FINRA). They adhere to a standard of conduct known as the “suitability rule,” requiring reasonable grounds for recommending specific products. The “know your customer” (KYC) aspect ensures brokers identify clients, understand their financial status, tax status, and investment objectives.

This differs from financial advisors registered with the Securities and Exchange Commission (SEC) as registered investment advisors (RIAs), who follow a strict fiduciary standard to always act in the best interest of the client.

Real Estate Brokers:

Brokerage Explained By The Pakistan: In real estate, a broker, licensed by each state, represents either the seller or buyer. Duties may include property valuation, listing, advertising, negotiation, and overseeing transactions through closing.

Examples of Brokers:

Full-service brokers like Morgan Stanley, Goldman Sachs, and Bank of America Merrill Lynch offer a range of services, including access to an inventory of shares. Agency brokers, like those executing trades for high-net-worth individuals, don’t carry an inventory but act as agents for clients.

How Brokers Make Money:

Brokerage Explained By The Pakistan: Brokers earn a salary and commissions on managed trades. The salary varies based on factors like client worth and the type of brokerage.

Becoming a Broker:

To become a broker, a background or degree in finance or economics is beneficial. Proper licensing is essential, making candidates eligible to perform broker duties.

The Bottom Line:

Brokerage Explained By The Pakistan: Brokers play a vital role in facilitating trades, earning a decent salary, and monitoring transactions to ensure smooth operations. While technology automates stock trades, brokers intervene in exceptional or unique situations.

Trade on the Go. Anywhere, Anytime:

Explore one of the world’s largest crypto-asset exchanges, Binance, offering competitive fees and dedicated customer support. Sign up for free to access tools for trade management, viewing price charts, and making conversions with zero fees. Join millions of traders and investors on the global crypto market.